An asset including a leased asset becomes non-performing when it ceases to generate income for the bank. A loan gets qualified as a NPA when the Interest and / or instalment of principal or a discounted bill remains overdue for a period of more than 90 days in respect of a term loan. An Overdraft / Cash Credit becomes NPA if the account remains ‘out of order’ in respect of an Overdraft / Cash Credit (OD/CC). In case of interest payments, bank should, classify an account as NPA only if the interest due and charged during any quarter is not serviced fully within 90 days from the end of the quarter. (Source: RBI Master Circular DBR No.BP.BC.2/21.04.048/2015-16 dated July 1, 2015)

Definition of Non-Performing Asset (NPA)

Non-Performing Assets

In the Indian Banking Sector, the moderation in the GNPA ratio, which started after the peak in March 2018, continued through 2019-20 and 2020-21 and had breached 7.5% by end-September 2020. The improvement was driven by lower slippages which declined to 0.74 per cent in September 2020 and resolution of a few large accounts through the Insolvency and Bankruptcy Code (IBC). Fresh slippages remained the highest among PSBs

The modest GNPA ratio of 7.5 per cent at end-September 2020 veils the strong undercurrent of slippage. The accretion to NPAs as per the Reserve Bank’s Income Recognition and Asset Classification (IRAC) norms would have been higher in the absence of the asset quality standstill provided as a COVID-19 relief measure. Given the uncertainty induced by COVID-19 and its real economic impact, the asset quality of the banking system may deteriorate sharply, going forward.

The rapid credit growth during 2005-12, coupled with absence of strong credit appraisal and monitoring standards and wilful defaults, are responsible for sizeable asset impairments in subsequent years.

The reduction in NPAs during the year was largely driven by write-offs (refer Chart below). NPAs older than four years require 100 per cent provisioning and, therefore, banks may prefer to write them off. In addition, banks voluntarily write-off NPAs in order to clean up their balance-sheets, avail tax benefits and optimise the use of capital. At the same time, borrowers of written-off loans remain liable for repayment.

Large Write-offs contributed to reduction of GNPA

Large borrower accounts (exposure of ₹5 crore and above) constituted 79.8% of NPAs and 53.7% of total loans at end-September 2020. The share of Special Mention Accounts (SMA-0) witnessed a sharp rise in September 2020. This may be an initial sign of stress after lifting of moratorium on August 31, 2020. However, the share of other categories of SMAs i.e., SMA-1 and SMA-2 remained at a relatively lower level

Recoveries

Insolvency and Bankruptcy Code (IBC), under which recovery is incidental to rescue of companies, remained the dominant mode of recovery in large borrower accounts. However, the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002 (SARFAESI) channel also emerged as a major mode of recovery in terms of the amount recovered as well as the recovery rate. With the applicability of the SARFAESI Act extended to co-operative banks, recovery through this channel is expected to gain further traction. Going forward, insolvency outcomes will hinge around uncertainties relating to COVID-19. The government has suspended any fresh initiation of insolvency proceedings in respect of defaults arising during one year commencing March 25, 2020 to shield companies impacted by COVID-19.

Banks/FIs and Asset Reconstruction Companies: A symbiotic relationship

Apart from recovery through various resolution mechanisms, banks also clean up balance sheets through sale of NPAs to Assets Reconstruction Companies (ARCs) for a quick exit. During 2019-20, asset sales by SCBs to ARCs declined which could probably be due to SCBs opting for other resolution channels such as IBC and SARFAESI. The acquisition cost of ARCs as a proportion to the book value of assets declined suggesting lower realisable value of the assets

The share of security receipts (SRs) subscribed to by banks steadily declined, reaching 66.7% by end-March 2020 from 80.5 per cent at end-March 2018 as ARCs were incentivised to increase skin-in-the-game and diversify the investor base by bringing in other financial institutions

(Source: RBI Report on Trends and Progress in Banking dated Dec 29, 2020)

Asset Reconstruction Industry in India

Asset Reconstruction Company (ARC) means a company registered with Reserve Bank of India, under Section 3 of Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI Act) 2002, for the purposes of carrying on the business of asset reconstruction or securitisation or both; “Asset reconstruction” means acquisition by any asset reconstruction company of any right or interest of any bank or financial institution in any financial assistance for the purpose of realisation of such financial assistance.

Background and Rationale for setting up Asset Reconstruction Companies (ARCs)

The Indian banking industry, saddled with Non-Performing Assets (NPAs) in the late 1990s with Gross Non-Performing Assets (GNPAs) as a percentage of advances for Scheduled Commercial Banks was at 15.7% as on March 1997. The existing legal framework relating to commercial transactions had not kept pace with changing commercial practices and financial sector reforms. This resulted in slow pace of recovery of defaulting loans and led to mounting NPAs.

The Central Government appointed Committees – Narsimhan Committee I and II and Andhyarujina Committee for examining banking sector reforms suggested the need for changes in the legal system. These committees recommend enactment of a new legislation for empowering banks and financial institutions to take possession of the securities and sell them without intervention of Courts. Acting on these recommendations, The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act, 2002) was approved by the Parliament.

The Committee on Banking Sector Reforms (Narasimhan Committee II) recommended setting up Asset Reconstruction Companies (ARCs) to transfer NPAs from Banks. Acting on these recommendations, the Union Budget of 2002-2003 proposed the establishment of ARCs by public and private sector banks, financial institutions and multilateral agencies to take over NPAs and develop markets for securitized loans.

The SARFAESI Act provided for the establishment of ARCs. Accordingly, on April 23, 2003, the RBI issued guidelines under the SARFAESI Act, 2002, for setting up Securitisation Companies or Reconstruction Companies (SCs/RCs).

Accordingly, in August 2003, Asset Reconstruction Company (India) Limited (Arcil) sponsored by State Bank of India, IDBI Bank Ltd., ICICI Bank Ltd. and Punjab National Bank was set-up as the first ARC in India.

Business Model of Asset Reconstruction Companies

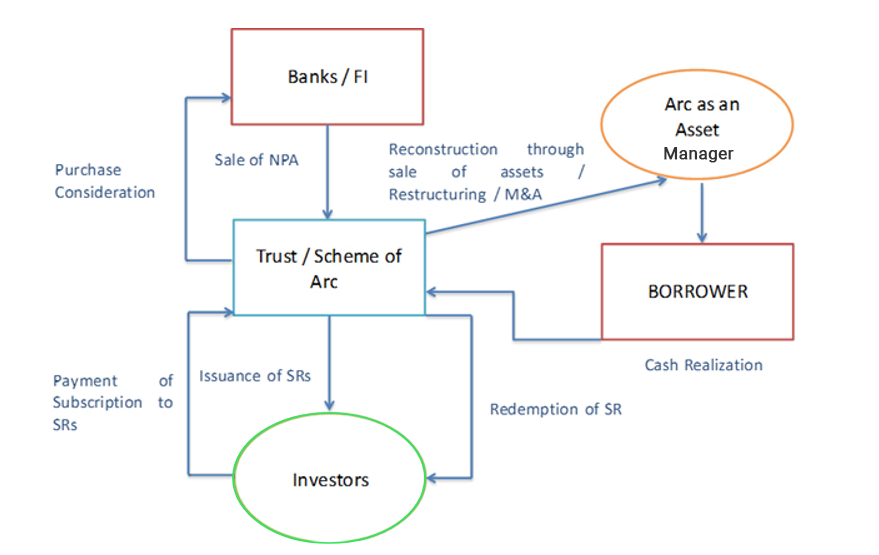

(Source: Asset Manager/ARC)

Acquisition process of NPAs

Under Section 5 of SARFAESI Act, 2002, Any ARC may acquire financial assets of any bank or financial institution: “By issuing a debenture of bond or any other security in the nature of debenture, for consideration agreed upon between such ARC and the bank or financial institution or by paying in cash”.

Banks auction NPAs to ARCs at a pre-determined Reserve Price and the same is sold to the Highest Bidder. However, instead of paying full acquisition cost to the Bank, ARCs pay the acquisition price to the Seller Banks under hybrid structure i.e. Cash & Security Receipts (SRs).

Special Features of SRs

The SRs issued by ARCs are predominantly backed by impaired assets. These SRS have following unique features:

- SRs cannot be strictly characterised as debt instruments since they combine the features of both equity and debt. However, these are recognised as securities under Securities Contracts (Regulation) Act, 1965

- The cash flows from the underlying assets cannot be predicted in terms of value and intervals

- The investment in SRs is restricted to QIBs only

- These investments when rated would generally be below investment grade. These investments are generally privately placed and presently not listed.

- In the event of non-realisation of the financial assets, the SR holders representing 75% of the total value of SRs issued by the SC/RC can call for a meeting of all the SR holders in a particular scheme and every resolution passed in such meeting shall be binding on the SC/RC.

CONTINUOUSLY EVOLVING REGULATORY LANDSCAPE

In a recent development, the FDI limit into an ARC has been increased from 50% to 100%.